An Optimal Client Service Model for Financial Advisors

06.09.19 | Dominique Henderson | 0 Transform

Go beyond a traditional service calendar to impress clients by crafting an optimal client service model for financial advisors

“So, you charge X. What is it that you DO to justify that fee?”

OK, so maybe you don’t get asked this point-blank. But this question is probably in the back of mind for your prospects, your current clients — and even you! While it might sound like this question is about the money, its heart is in the client service model for financial advisors.

The good news is that technology helps us create customized client service models more efficiently than ever before.

The bad news is that there are many misconceptions about what an optimal service model is. It’s difficult to define an optimal client service model for financial advisors because every practice is different.

Another challenge? Implementing your service model, so that your clients get exactly what you’ve promised. There are too many practices where an advisor is racing from one emergency to the next while squeezing all the annual review meetings into December and January. That’s hardly strategic — or good for the clients!

The problem with an AUM-driven segmentation approach

Traditionally, advisors have built their client service models by segmenting their practices based on AUM. This “segmented” the practice into your A-list, B-list, and C-list clients. In practice, though, the underlying service model would often be exactly the same. Higher-net-worth clients would just get more frequent facetime with the advisor.

The problem with that approach is that it isn’t grounded in what your clients value.

Sure, AUM-driven segmentation is easy to implement. It’s convenient for you as their advisor. It allows you to have more meetings with those who are likely to bring in more assets. In many instances, this service model is a solution built for the advisor — not the client.

So, how do you create a service model that truly serves your clients — and is efficient on the back end?

Step 1: Assess whether your practice is suited for a single service model.

If your practice is focused on a single niche, it makes sense to have a single service model. Your clients probably struggle against the same pain points and value similar things.

However, if you happen to serve more than one market, you will need different service models.

This isn’t just about the number of meetings with the advisor! From blog posts and emails, to client appreciation events, different audiences expect and appreciate different things. A great touch-point for a tech entrepreneur client might be a weekend of snowboarding in Boulder — not a wine-and-paint night you might host to raving reviews from a pre-retiree audience.

So, begin with what your clients want. Some may, in fact, want more frequent meetings (although a recent survey from Oranj shows that less than 20% of those who work with an advisor wish for longer or more frequent meetings). From services you provide, to products made available, to the technology platform used, to client appreciation events — map out what you plan to do to serve your clients and turn them into raving fans.

See also: Building a Financial Advisor Value Proposition that Someone Will Buy

Step 2: Set expectations – and a plan to meet them.

Now that you are clear on what you plan to do for your clients, you need to set your expectations. This exercise should be done internally first, although you will use the end result to enroll new clients into the vision of service and value they are signing up for.

Some advisors begin with a simple outline of client-service activities and events (one client appreciation event per year, one educational event per year, two review meetings per year, etc.)

Others use a service calendar that maps client service activities to specific months (for example, in February we update financial planning projections, in June we do insurance reviews, etc.)

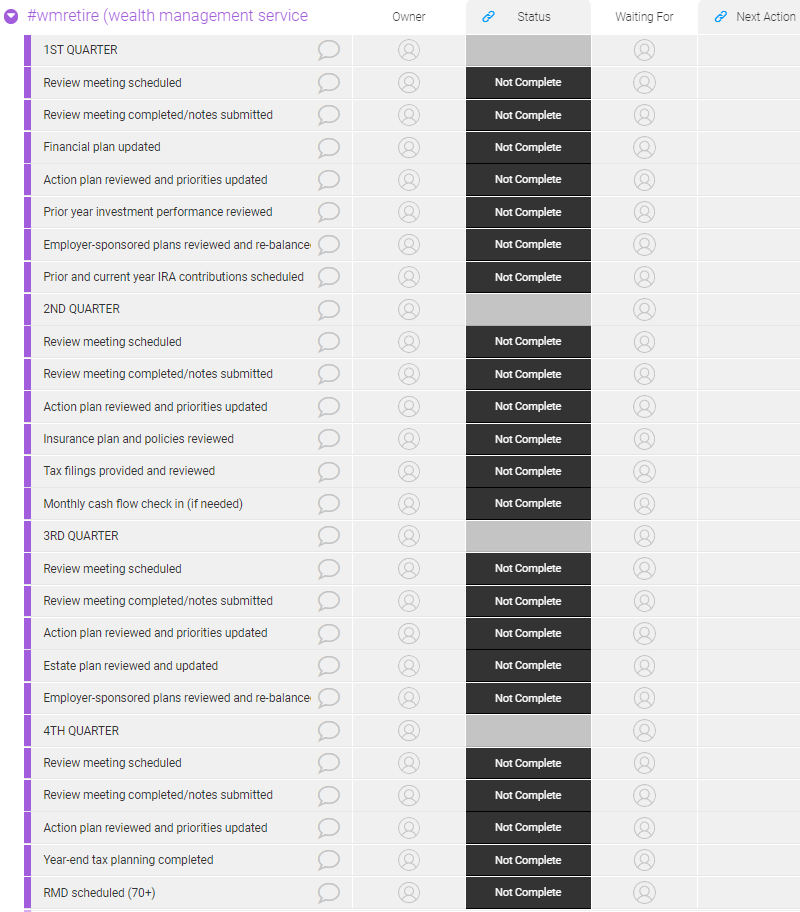

Let’s use SurePath Wealth Management as an example. The SurePath team found that the service calendar model had one major drawback. It wasn’t actionable. So, they created specific action items in their workflow management system (the SurePath teams uses Monday) — and applied tags to automate everything.

This is a sample screenshot of activities associated with SurePath’s retiree clients. Action steps for other client segments look different. Each action is assigned to an individual who is responsible for completing it. There are deadlines, automated reminders, and a built-in accountability system.

See also: Why It’s Dangerous to Automate Client Experience

Step 3: Remember that content is a part of the client service model for financial advisors!

Your blog posts, videos, published articles, social media posts, emails, and newsletters are some of the ways you add value for your clients and prospects. These are your tools and platforms for educating your audience, staying connected, and showing your human side. So, be sure to create a content plan as an integral part of your service model!

There is no one-size-fits-all approach for building a content plan. I like to map out content ideas about a month at a time. That allows me to stick to my release schedule, use my time efficiently, and stay flexible as new topics arise.

Building an optimal client service model for financial advisors

So, in summary: an optimal client service model for financial advisors begins with defining what your clients value. Create a client service model by turning these value points into repeatable and actionable items on your calendar. Assign responsibility for actions and set up an accountability system. Finally, don’t overlook your content plan. Doing these things will result in a service your clients want — and your business will be better for it!