Do Clients Actually Care About Your Client Portal?

06.18.19 | Patrick Brewer, CFA, CPA | 0 Transform

Why the answer is typically “No”… and how to turn it into a “Yes!”

Technology spending for FinTech is on the rise. Among the many tools available to a typical advisor these days, client portals are at the top of the list. According to the 2018 Financial Planning Tech Survey, 80% of advisors offer an access portal to their clients.

Whether powered by eMoney, Orion, RightCapital, or another vendor, the ultimate goal of most portals is three-fold. One, aggregate financial data. Two, give the client a snapshot of where they stand. And three, allow them to check up on their status or progress 24/7.

What could possibly go wrong with investing in an amazing tool that promises convenience, real-time data, and a user-friendly interface?

Low adoption rates can sink your ROI

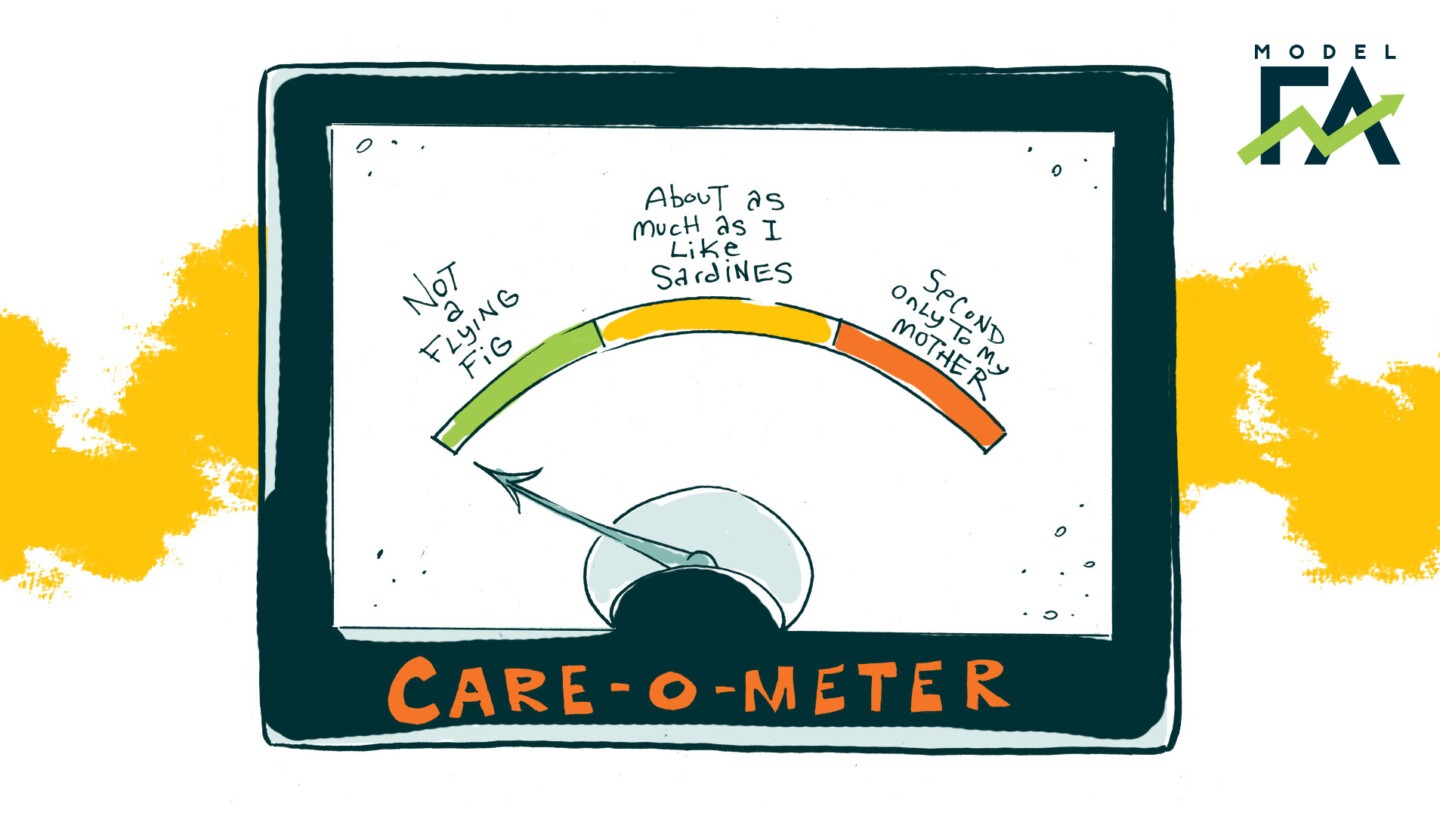

In our experience, without proper guidance most clients don’t care about the client portal.

Many don’t remember that they have access to one. Or they’ve forgotten their log-in credentials. Or they don’t use it frequently enough to learn which sections matter to them.

So yes, you may have invested in the portal because “everyone has one”, or because you personally loved the functionality or the interface of the tool you picked. But unless you have a strategy to drive the adoption of the client portal, it’s likely to go mostly unused by your clients.

Here’s a common mistake we see. An advisor might send clients a “canned” monthly or quarterly update. Perhaps that email includes a market update, a blurb about the economy or the interest rates, maybe a section on financial planning or a note about a tax deadline. The same email lists a link to the client portal — presumably a sufficient reminder to encourage clients to visit it. But that’s not enough! As a result, most clients delete or archive the email — and never visit the client portal.

Which is a missed opportunity.

See also: Building a Financial Advisor Value Proposition that Someone Will Buy

Our blueprint for maximizing the value of the client portal

One way that we have been successful in increasing the adoption of our client portal is by combining it with personal video reports.

Here’s how it works.

Every quarter, the client receives an email with a personal video from their client concierge. In our firm, one client concierge serves 3 advisors. The client knows “their” concierge from office meetings, phone conversations, and previous email exchanges — so, it’s a familiar face, even if the video isn’t recorded by the advisor.

On video, the concierge walks through the client portal. Investments, financial planning, action list with to-do items — each section is covered in turn, along with an overall summary. How is the client doing? How are the markets doing? What’s new? What requires attention? The video follows a script for completeness and efficiency, but the discussion is personalized for every single client.

See also: Why It’s Dangerous to Automate Client Experience

How do we do this?

We use a tool called Loom to record the video and embed it in the email. Even better, we can include a live link to the client portal in the top corner of the video!

Adding this workflow has been very successful for us. First off, clients don’t even need to visit the client portal to get value. After all, they have hired us because they don’t want to spend their free time pouring over financial plans and investment reports. They just want to make sure that we are thinking about it for them— and that they are kept informed about anything that’s a concern or an action.

The other reason why this strategy works is it allows clients to log into the portal for a specific reason.

Now, instead of just having a vague idea that the client portal has some useful stuff inside, they might visit it to look at a specific financial planning goal, investment, or document. This exposes them to different sections inside the portal, gets them familiar with the interface, and encourages interaction on their own terms.

So, if your client portal adoption rates have been disappointingly low, give this video strategy a try!

Using a different strategy to drive client portal adoption? Sound off in the comments. Someone in the Model FA community is probably looking for ideas on this right now — and would appreciate your help.